2025 New Pension Calculation Rules in Pakistan – Everything You Need to Know

Table of Contents

Introduction

2025 New Pension Calculation Rules

Multiple Pension Clarifications

Future Pension Increase Methodology

Conclusion

2025 New Pension Calculation Rules & Policy Changes

1. Introduction

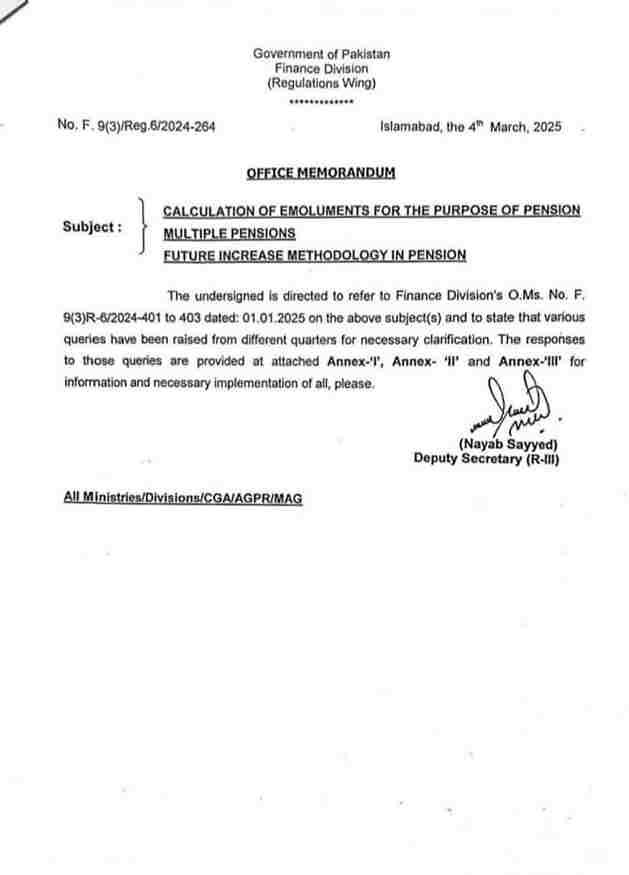

On March 4, 2025, the Government of Pakistan’s Finance Division (Regulations Wing) issued an Office Memorandum (O.M.) No. F. 9(3)/Reg.6/2024-264, providing important clarifications regarding pension calculations, multiple pensions, and the future increase methodology in pensions. This directive responds to various queries from government employees and departments, ensuring transparency in pension policies.

2. 2025 New Pension Calculation Rules

The Finance Division’s memorandum addresses key concerns related to emoluments for pension calculations. Some of the major clarifications include:

Usual/Notional Increment Consideration: Employees completing six months of service in the year of retirement will not have their usual/notional increment included in the 24-month average emoluments. Instead, it will be added separately after calculation.

Current Charge Allowance:Any additional pay received due to temporary charge of a post will be considered as part of the pensionable emoluments.

Applicability of Rules: The new pension calculation rules will not apply to employees currently on Leave Preparatory to Retirement (LPR), those availing LPR encashment, or those under a notice period for voluntary retirement.

Fractional Service Inclusion: If an employee retires in the middle of a month, their service for that partial month will be considered a full month in the pension calculation.

3. Multiple Pension Clarifications

The memorandum also provides directives regarding multiple pensions:

Existing Pensioners: Employees who were receiving multiple pensions before January 1, 2025, will continue to do so under previous regulations.

New Pension Rules from 2025: Employees re-employed on or after January 1, 2025, will be required to opt for a single pension.

Family and Self-Pension: The new rule applies to both self and family pensions, as outlined in O.M. No. 9(3)R.6/2024-402.

4. Future Pension Increase Methodology

While the memorandum does not explicitly outline the future pension increase methodology, it is expected that adjustments will be based on:

Inflation rates and economic conditions.

Sustainability of the government’s pension fund.

Alignment with overall pay and pension policies of the government.

Read this post also:

Exciting Top 15 China Affiliate Programs to Watch in 2025

5. Conclusion

The recent Office Memorandum from the Finance Division provides clear directives on pension calculations, multiple pension eligibility, and future pension increases. These clarifications are crucial for government employees to understand their retirement benefits.

For further details, government employees should refer to the official annexures provided in the memorandum. For more details

[…] 2025 New Pension Calculation Rules in Pakistan […]